Intelligent automation for banking service

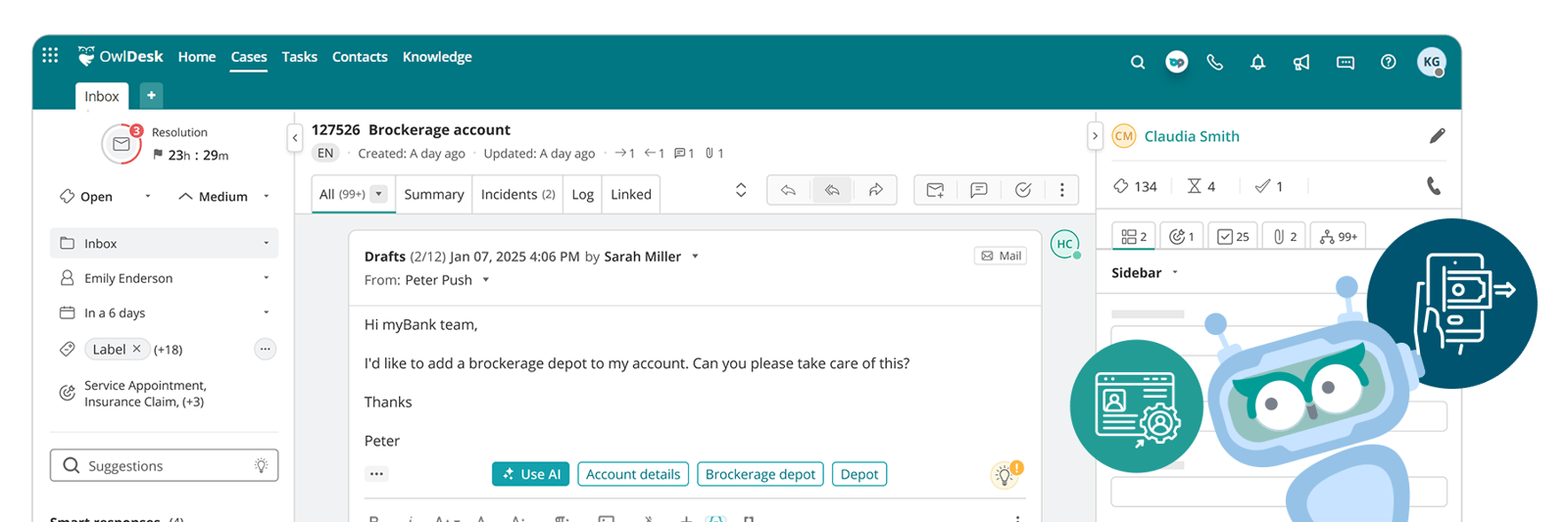

ThinkOwl AI agents handle recurring service tasks in banking. It manages inquiries about account balances, payments, credit status, disputes, or lost cards. This reduces processing times and costs while freeing up service teams to focus on value-added advisory tasks. The result is higher efficiency, fewer errors, and top-notch service – available 24/7 via phone, chat, email, or Banking-App.

Less manual effort

End-to-end automation

Increase in customer satisfaction

Streamlined financial processes

"The most surprising insight was that the digital adoption rate significantly exceeded our expectations. This was true even for traditional branch banks."

Daniela Fahrion

Client Management | SPS Germany

Financial service providers: Seamless form processing

Applications arrive via PDF, scan, or fax. Case handlers must manually enter and verify the information.

IDR recognizes the document type, extracts the data, checks for completeness, and transfers it to the DMS. If information is missing, a follow-up process is automatically initiated.

70% less manual effort, 50% faster processing.

Specifically tailored to the financial sector

Accelerating time-to-value

Your assurance of security

Self-service that builds trust

Today’s banking customers expect instant answers, whether it’s about transfers, credit status, or card inquiries. ThinkOwl AI agents deliver a seamless and intuitive self-service experience across all voice and non-voice channels 24/7. AI bots flexibly operate as autonomous service agents or as smart assistants supporting your teams.

Trusted Security, Certified

Complies with ISO 27001 and all legal requirements in banking and finance.

Seamless channel switching

Voice, chat, or email – customers can switch channels anytime during an interaction. For example, from a voice assistant to a chat message on their smartphone.

Multilingual support

Real-time translation up to 80 languages, making customer service truly borderless.

All-in-one platform for the financial sector

ThinkOwl is the intelligent automation platform for customer service and processes in the financial industry. It works seamlessly across channels – from voice, chat, email, and social media to documents. Thanks to its low-code technology, ThinkOwl can be quickly and flexibly adapted to the requirements of banks and financial service providers.

Banking & Finance

Banking & Finance

Banking & Finance

Banking & Finance

eCommerce & Retail

Common challenges

- Order, payment, and shipping queries

- Multichannel complexity and inconsistency in communication

- Pressure to respond instantly

- Seasonal demand spikes

Key solutions

- Scalable ticket management and automated case routing

- Streamlined service workflows using RPA and AI

- Conversational AI bot for automated client interactions

- Omnichannel communication facility for unified customer engagement

Banking & Finance

Common challenges

- Complex transaction queries

- Complexities in regulatory compliance

- Fraud and security risks

- Volume spikes related to campaigns

Key solutions

- Automated routine transaction support

- Built-in workflows for compliance enforcement

- Real-time AI-based flagging of suspicious activities

- AI-driven traffic management for campaign-related surges

Utilities & Energy

Common challenges

- High volume of billing and outage-related inquiries

- Service complaint and escalation management

- Limited availability of self-service options

- Inconsistent service quality and feedback mechanisms

Key solutions

- AI bots (voice & chat) for handling routine questions

- Automated case routing and SLA management

- Self-service portals for usage visibility and bill payment

- Quality assurance with integrated performance metrics

Travel & Hospitality

Common challenges

- Frequent booking and cancellation requests

- Multi-channel guest communication

- Language and time-zone barriers

- Post-trip feedback management inefficiencies

Key solutions

- Conversational bots for automating common booking and cancellation tasks

- Omnichannel messaging across email, chat, SMS, and social media

- >Multilingual virtual assistants designed to support global guest

- Customer feedback collection via survey tools with CSAT and NPS metrics

Telecommunications

Common challenges

- Repetitive questions on data, roaming, and SIM setup

- High churn from network issues or

service disruptions - Siloed systems across CRM, billing, and network tools

- Lack of workflow automation

Key solutions

- Chatbots and voicebots for 24/7 client query handling

- Timely multi-channel notifications and updates

- Software integration for unified data interface

- Intelligent automation using BPMN

Insurance

Common challenges

- Application and claim processing delays

- Complex inquiries and long processing times

- Manual paperwork

- Lack of information and DIY facility

Key solutions

- RPA and AI-driven process automation

- AI bots for instant customer query handling

- Digitalization of paperwork with OCR and e-signature technologies

- Self-service and end-to-end digital claim management portals

Logistics & Transport

Common challenges

- High inquiry volumes

- Manual document processing

- Staff shortages

- Difficulty in data flow across multiple software

Key solutions

- AI case management for automated resolution processes

- AI-based digitalization of document processing

- Intelligent suggestions and case pre-sorting for support staff

- Third-party software integration with data extraction

Education Institutions

Common challenges

- Queries about courses, schedules, and exams

- Difficulty managing multi-channel communication

- Language barriers in student support

- Inefficient feedback collection and follow-up processes

Key solutions

- Conversational AI for answering common student queries

- Unified communication for omnichannel interaction management

- Multilingual support with AI-powered translation tools

- Feedback collection via surveys with automated follow-ups

Healthcare

Common challenges

- Appointment scheduling delays and long wait times

- Inefficient patient data management

- Low patient engagement

- Fragmented care coordination between providers

Key solutions

- AI-driven scheduling to reduce wait times

- Integrated systems for unified data management

- Automated reminders and patient portals

- Centralized platforms for care coordination